Personal Finance Back to Basics: Financial Goals (Part 3)

If you’re reading this, I assume that you have completed your emergency fund or, like us, have a plan in motion for completing it. If not, please read the previous post first.

After building our emergency fund and before aggressively investing, the next step is to write down our financial goals. This is called goal-based investing. It is the idea of associating every investment you make with a specific life goal. It involves asking these questions:

- What are your (and your family’s) life goals?

- How much do each of these cost?

- When and for how long?

Having a vision will give you direction and purpose. And this will help you enjoy saving, or at least find the strength diligently endure. The vision will help you remember that this is only a temporary effort to achieve a future goal.

Disclaimer: This is a very personal post, but I hope this will influence you to think along the same lines for yourself.

Our Current Financial Goals

1. Children’s Education

Like many families, children’s education is one of the top goals. I need to ensure that my son’s education is financially covered until university. How much is education in Singapore until graduation? Can we afford it?

Research

To plan for how much we need for my son’s education, I need data. These are the sources I managed to gather at the moment:

- https://www.guidemesingapore.com/business-guides/immigration/get-to-know-singapore/international-schools-in-singapore-fee-comparison

- http://brands.dollarsandsense.sg/diyinsurance/how-much-will-your-childs-university-education-cost-in-singapore/

Now I have heard before that education fees in Singapore are very expensive for foreigners, but only now did I know how expensive it really is! For comparison, the monthly-equivalent of these fees can be compared to a year of tuition in the Philippines! But of course, one can argue that the quality of education is also a lot higher, justifying the price.

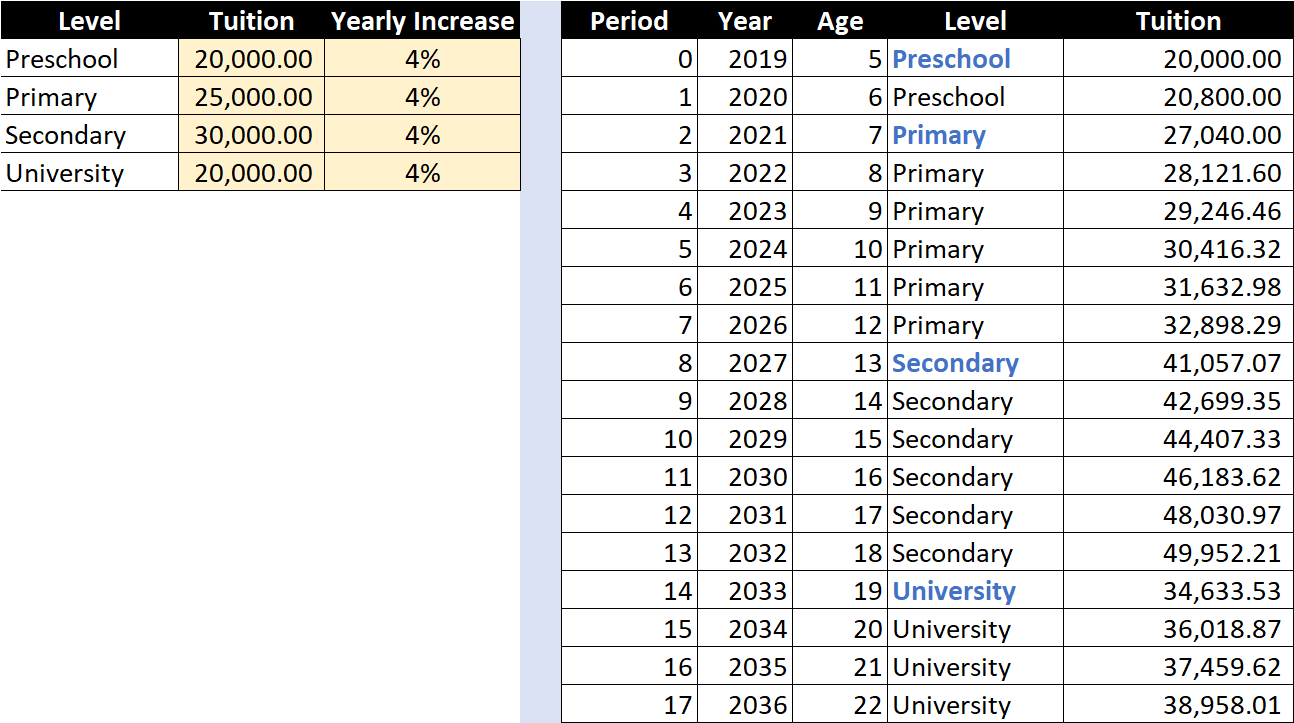

Based on these initial data, I make the following year 2019 assumptions:

- Pre-school: S$20,000/year, increasing at 4% per year

- Primary: S$25,000/year, increasing at 4% per year

- Secondary: S$30,000/year, increasing at 4% per year

- Local University: S$20,000/year, increasing at 4% per year (Foreigners are no longer limited by residency status when it comes to local university applications, so long as the child is accepted)

Which then allows me to make estimated projections:

Plan for Primary School

I find it improbable to fund the primary school fees through investments. So a more realistic plan is to simply pay this out of our monthly income: S$1700-2100/mo in today’s terms, where monthly expense increases by the rate of the yearly tuition fee increase. Yes, it is quite hefty. But I’m just being realistic.

Plan for Secondary School & University

Next is secondary school (lower and upper) as well as university. For this, I used the MS Excel Solver add-in.

Assumptions

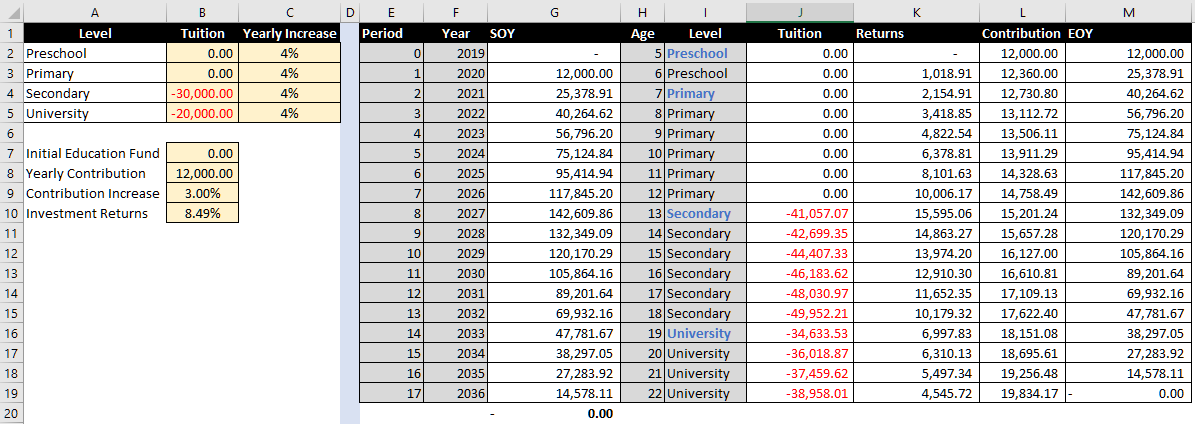

- Be able to set aside $1,000/mo (on top of current primary school expenses) for the Education Fund, totaling $12,000/year

- Yearly contribution increases at the rate of assumed inflation, which is 3%. (Hence, I am also assuming that our yearly income will increase by a minimum of 3%)

- Be able to set aside a full-year contribution before the End-of-Year (EOY) 2019 so that the contributions can start earning from investments at the Start-of-Year (SOY) 2020.

Computation

Using solver to change B10 until G20 equals 0, it computes that we will need a financial instrument that returns at least 8.49% per year for this to work.

Now, in my non-professional knowledge of Singapore, I’ve yet to see investment instruments that promised or performed beyond 10% consistently, year-on-year. High-yield REITs, my current favorite, usually give around ~7% dividend yield. This is unlike the Philippines, where there are funds that performed 15-20% per year. But of course, PHP is also a lot more volatile compared to SGD.

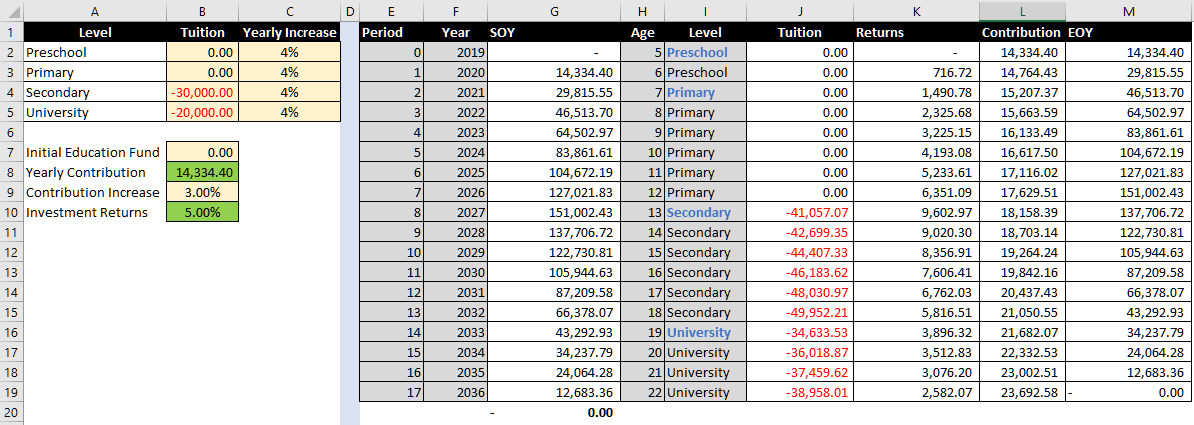

In short, I find that looking for a fund giving 8.49% returns is very risky. 5% feels a lot more realistic and conservative. Using this input, I changed B10 and solved for B8 instead. This outputs the following:

By increasing the contribution from $12,000/year to $14,334/year (or $1,195/mo), the same goal can be accomplished with a more conservative financial instrument. Excess returns can be used to speed up the goal or invested in our future retirement fund.

2. Income Protection

In the last post, I shared that the emergency fund is for an emergency event of temporary loss of income. That means that I need a working plan in the event of a permanent loss of income. I list 3 things that can potentially cause this (as a knowledge worker):

- Death

- Brain/Mental disease

- Hand disability (which affects my ability to write software)

Research

I’ll have to talk to some insurance agents to know the details but for now, I have found these 2 points of reference:

- https://investmentmoats.com/budgeting/insurance/cheapest-term-life-insurance-in-singapore/

- https://blog.moneysmart.sg/health-insurance/integrated-shield-comparison/

At least according to these articles, it seems that I should plan to pay for at least $1500-2500/year to get life and health insured with basic coverage. But before deciding, I’ll also need to take a look at whole life insurance options.

Thoughts for now

I’ll need to spend a lot of time to think through the various scenarios in order to compute how much coverage we really need. If I lose my ability to earn at the moment, my family will have to move back to Manila (since we are on EP/DP). If this is the case, then the coverage will have to be based on Manila’s rates.

Computing for the amount of insurance coverage needed is a long discussion, which I will not attempt to explain as there are many existing resources on this topic. But if you need a quick way to know, here are 2 options:

- Compute the sum of 10 years’ worth of living standard expenses, which grows at the rate of inflation. This is the simplified recommendation of a few financial advisors whom I spoke with in the past. The assumption is that the family left behind will be able to recover and find new sources of income before the 10 years run out.

- Consult a trusted financial planner/advisor who is not focused on selling a specific insurance product (you can usually tell when you start talking to the person). He/she will help you compute based on your life context.

As a pre-requisite though, you’ll need to have an accurate estimate of how much you’re spending and saving per year. We ourselves don’t have this accurate estimate yet, so I’ll just revisit this after getting at least a 6-month spending average.

3. Retirement

This is less a less immediate but very important goal. Once emergency funds and the above 2 goals are in order, I’ll start researching the lifestyle and living expenses of retirees in Singapore. Besides, it is still unclear where we will retire at this point—in Singapore, in Manila or elsewhere? So I’ll park this goal for now.

What’s yours?

Most of the above is about me and my family, but I hope it gave you insight on how you can start having articulated financial goals. Please do take the time to write your goals after reading this post.

- If you’re single, then you’ll probably have very different goals (like buying a ring!).

- If you’re married, take your spouse on a date and talk about it.

I recommend that you don’t start investing until you’ve at least scribbled a few goals down. Your goals will determine your investment horizon and risk appetite. More on this later.

The next post is about financial boundaries.